Formula Growth Limited is highly experienced in navigating the small and mid-cap global stock markets. The investment team seeks to uncover high conviction investment ideas in this large, inefficient and often less understood segment of the market.

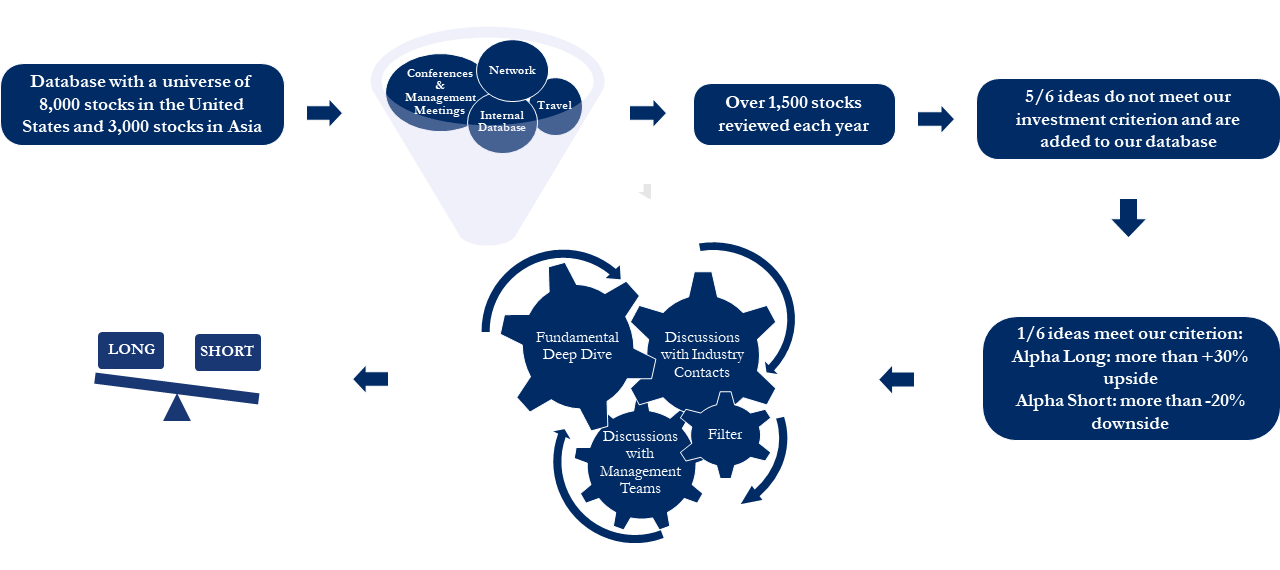

IDEA GENERATION

- Experienced investment team constantly sourcing ideas while using exceptional decision-making to build portfolios

- Each investment professional typically has 2-3 sectors of expertise

- Extensive network with regional relationships built over 60+ years

- Currently more than 3,000 companies on file within our internal database or researched companies

- Meetings with over 1,500 management teams a year

- Extensive travel and international research office in New York City

RESEARCH PROCESS

What we look for:

- Growth at a reasonable price

- Expected returns of more than 20% over a 6 to 18 month time horizon

- Rerating in growth and multiples versus expectations

- Catalysts

The investment team looks for long investment positions that are overlooked or undervalued based on fundamental valuation criteria.

Typically, our long positions:

- Are growing revenue and earnings rapidly and above consensus

- Are experiencing a cyclical recovery in the industry in which they participate

- Are restructuring or cutting costs to improve profitability

- Have low absolute valuations

- Have security prices that have been impaired by temporary events

Short investment positions include those that are overvalued or that have structurally broken business models operating in challenged industries.

Typically, our short positions:

- Are experiencing a cyclical slowdown and lowered margins

- Are likely to face loss of market share, revenue, or earnings due to competitive displacement

- Have significant debt refinancing risk

- Have high absolute earnings or cash flow valuations

SIZING &

IMPLEMENTATION

- All Formula Growth Limited products benefit from a common research platform where highly experienced and qualified investment professionals generate ideas

- Investment professionals are responsible for the position sizing as well as adherence to portfolio objectives

- Sizing is a function of conviction, portfolio limits and liquidity

- The risk committee, led by the CIO, is responsible for ensuring compliance to security regulations, to investment policy and procedures as well as the highest ethical standards

Our experience, our network and our broad coverage of the US small/mid cap space leads to many investment ideas. Thorough fundamental research and repeatability of the process are key to the success of Formula Growth Limited.